Top investment opportunities in Nigeria for 2023

Umaru Hassan

Investing is an essential aspect of building long-term wealth. With the right investment strategy, you can build a solid financial foundation and secure your future. Nigeria, with its abundant natural resources, growing population, and thriving economy, presents a vast array of investment opportunities. In this blog post, we will discuss the top investment opportunities in Nigeria for 2023.

Why is investing important?

Before we explore the top investment opportunities in Nigeria, it is essential to discuss the importance of investing.

- Wealth building: Investing provides an opportunity to grow your money over time and build long-term wealth. By investing, you can potentially earn returns that are higher than inflation and savings rates.

- Beat inflation: Inflation erodes the value of your money over time. Investing in assets that appreciate in value can help you stay ahead of inflation and maintain your purchasing power.

- Achieve financial goals: Whether you want to save for retirement, buy a house, or pay for your child’s education, investing can help you reach your financial goals faster.

- Diversify your portfolio: Investing in a range of assets, such as forex, real estate and mutual funds can help you spread your risk and reduce the impact of market volatility.

- Create passive income: Some investments, such as rental properties or dividend-paying stocks, can provide a steady stream of income without requiring ongoing effort or work.

8 Top investment opportunities in Nigeria for 2023

- Real Estate

- Cryptocurrency

- Small and Medium Scale Enterprises (SMEs)

- Foreign Exchange Trading

- Tech

- Treasury Bills

- Mutual Funds

- Agriculture

1. Real Estate

The Nigerian real estate industry holds immense potential for investment in the country, owing to the rising population and housing demand. This market guarantees high returns on investment and includes a variety of properties in high demand such as:

- Residential Properties

- Commercial Properties

- Land

- Mixed-Use Properties and more.

The investment returns vary across different regions of Nigeria. For instance, in Lagos, select real estate investment plans provide an annualized yield of 10% and a guaranteed capital gain of 10% to 20% over two to four years on particular properties.

If you’re considering investing in the Nigerian real estate market, you can explore various opportunities such as rental properties, commercial real estate, and more. You can learn more about investing in this market by referring to our blog post “8 Best Ways to Invest in Real Estate in Nigeria.”

Related: The Top 9 Real Estate Investment Apps in Nigeria

50 real estate terms used in Nigeria you should know

2. Cryptocurrency

Investing in cryptocurrency in Nigeria has become increasingly popular in recent years. Cryptocurrencies such as Bitcoin, Ethereum, and others have gained significant attention and adoption among Nigerian investors.

One of the reasons for this is the country’s large population of tech-savvy youth, who are attracted to the decentralization and borderless nature of cryptocurrencies. Additionally, the high inflation rate and unstable local currency, the Nigerian Naira, has led many Nigerians to seek alternative investment options.

To invest in cryptocurrency in Nigeria, you first need to open an account with a reputable cryptocurrency exchange. Some popular exchanges in Nigeria include Busha, Binance, and Quidax. These exchanges allow you to buy and sell cryptocurrencies using Nigerian Naira or other major currencies.

It is important to note that investing in cryptocurrency can be risky, as the value of cryptocurrencies can be volatile and subject to large fluctuations. It is essential to do your research and understand the risks before investing. Additionally, it is important to keep your cryptocurrencies safe by using a secure wallet and following best practices for securing your account, such as using two-factor authentication and keeping your private keys secure.

3. Small and Medium Scale Enterprises (SMEs)

Small and Medium Scale Enterprises (SMEs) are the backbone of the Nigerian economy. The National Bureau of Statistics reports that Small and Medium-sized Enterprises (SMEs) make up 96% of businesses and 84% of employment in Nigeria. These SMEs number around 17.4 million, and they generate approximately 50% of industrial jobs and almost 90% of the manufacturing sector, measured by the number of businesses operating.

How to Invest in SMEs

Investing in small and medium-sized enterprises (SMEs) is an excellent way to support local businesses and make a profit at the same time. This involves providing funding to help these businesses grow. You can choose to invest in SMEs either through:

- Equity: Equity financing entails purchasing shares in an SME

- Debt financing: Debt financing involves giving a loan to the SME

- Additionally, there are crowdfunding platforms where you can also invest in SMEs.

4. Foreign Exchange Trading

Forex involves buying and selling currencies to make a profit. The Nigerian Forex market is regulated by the CBN and offers several opportunities for investors.

Some Forex trading strategies that you can use include trend trading, range trading, and breakout trading. These strategies involve analyzing market trends and making trades based on those trends.

To invest in Forex trading, you need to open a Forex trading account with a broker. There are several Forex brokers in Nigeria, such as FXTM, XM, and HotForex. After opening an account, you can start trading currencies and making profits.

5. Tech

The technology industry in Nigeria has experienced remarkable growth in recent years, evidenced by the emergence of various tech startups that have attracted substantial investments from both local and foreign investors.

Furthermore, Nigeria boasts of a rapidly expanding pool of tech talent, which is supported by a plethora of tech hubs and incubators. Consequently, the industry has access to a vast talent pool, robust funding mechanisms, and favourable policies that position it for exponential growth.

Investing in Nigeria’s tech startups typically involves providing seed funding or venture capital. Interested investors can choose to invest through venture capital firms, angel investor networks, or by directly investing in the startups themselves.

Overall, the Nigerian tech industry is an attractive investment destination, offering a wealth of opportunities for investors looking to tap into its potential for growth and innovation.

6. Nigeria Treasury Bills

NTBs are short-term debt securities issued by the government to raise funds from the public. They are considered one of the safest investment options in Nigeria because they are backed by the full faith and credit of the federal government. Treasury Bills have different tenures ranging from 91 days to 364 days, and they are issued through auctions held by the Central Bank of Nigeria (CBN).

The returns on Treasury Bills are not fixed and vary based on the investment period. As of January 2023, Market Forces Africa reported that the yield on 364-day bills was 4.78%. Conversely, the yield on 91-day bills was 0.29%, while that of 182-day bills was 1.80%. You can earn more significant returns by opting for longer tenures, but this comes with the risk of interest rate fluctuations.

How to Invest in Treasury Bills

Investing in Treasury Bills is easy and straightforward. You can participate in the auctions by filling out an application form and submitting it to an authorized dealer bank. The minimum investment amount is usually N50,000. At the end of the tenure, the principal and interest are paid directly into your bank account. Treasury Bills can also be traded on the secondary market.

7. Mutual Funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. Mutual funds offer you the opportunity to diversify your portfolios and invest in a variety of assets such as stocks, bonds, and real estate. They are managed by experienced fund managers who make investment decisions on behalf of investors.

Some of the mutual funds in Nigeria include the Stanbic IBTC Aggressive Fund, FBN Money Market Fund, and the ARM Money Market Fund. To invest in mutual funds, you need to identify a reputable fund manager and fill out an application form. The minimum investment amount varies depending on the fund manager, but it is usually between N5,000 and N100,000. Mutual fund units can be purchased and redeemed on any business day, and the proceeds are usually paid into your bank account within a few days.

Related: All you need to know about diversifying your real estate portfolio

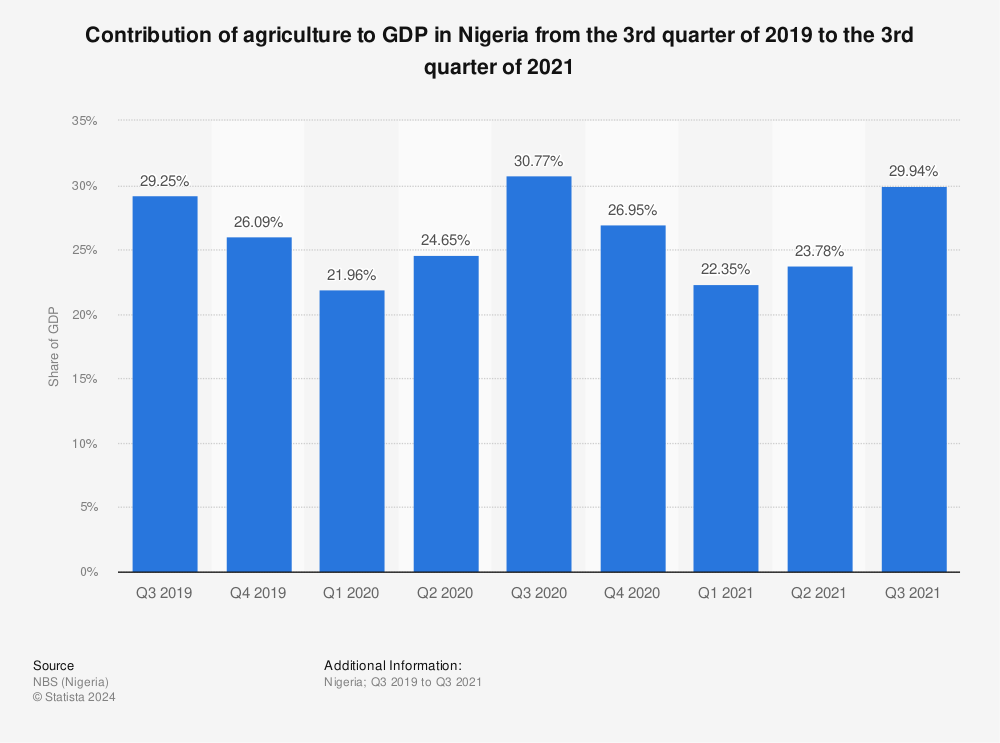

8. Agriculture Investments

Nigeria’s agricultural sector is the largest employer of labour in the country and contributes significantly to the GDP. The sector has immense potential for growth and development, given the country’s vast arable land and favourable weather conditions.

This statistics was gotten from Statista

You can explore various investment opportunities in Nigeria’s agricultural sector, such as:

- Crop cultivation

- Livestock farming

- Agro-processing

- Export of agricultural products.

The expected returns on agricultural investments vary depending on the type of investment and the level of risk. You can expect to earn attractive returns on investments in agricultural commodities such as rice, cassava, plantain poultry and catfish farming. You can also earn returns by investing in agro-processing ventures or by leasing land to farmers.

Related: How to Analyze a Real Estate Investment Opportunity

How inflation affects real estate investments in Nigeria

Risks associated with investing in real estate in Nigeria and mitigations

Conclusion on the top investment opportunities in Nigeria for 2023

In conclusion, Nigeria is a land of immense potential, and the investment opportunities available in the country are numerous and varied. Whether you are looking to invest in agriculture, tech, or real estate, there is something for everyone.

While each investment opportunity has its own unique set of risks and rewards, it is important to remember that investing always carries some level of risk. As an investor, it is up to you to do your due diligence, conduct research, and make informed decisions based on your risk tolerance and financial goals.

If you are considering investing in real estate in Nigeria, I would like to offer you a unique opportunity to consider. The STOW Fractional Home Investment Plan streamlines the process and minimizes the expenses involved in investing in specific real estate assets. It ensures a definite return on investment, along with capital gains within a specified timeframe. With this plan, investors can expect an annual yield of 10% and a confirmed capital appreciation ranging from 10% to 20% over a period of two to four years on designated properties.

Investing in real estate with STOW can provide you with steady cash flow, appreciation, and a hedge against inflation. Moreover, it offers a unique opportunity to participate in the economic growth and development of Nigeria, while also enjoying the benefits of property ownership. Our team of experts will work with you every step of the way to ensure that your investment journey is a success. So, take action today and invest with STOW to secure your financial future in Nigeria.

[…] Top investment opportunities in Nigeria for 2023 […]

[…] investment opportunities in Nigeria for […]

[…] Top investment opportunities in Nigeria for 2023 […]