Factors to consider before investing in real estate in Nigeria: 7 of the best

Umaru Hassan

Are you considering investing in real estate in Nigeria? Before you take the plunge, it’s essential to understand the factors that can make or break your investment. Nigeria is a country of great potential, but also one with many challenges. To make a successful real estate investment in Nigeria, you need to be aware of the factors that can impact your investment. In this blog post, we’ll explore the 7 factors to consider before investing in real estate in Nigeria, so you can make an informed decision and avoid costly mistakes. So, if you’re ready to learn how to navigate the world of real estate investing in Nigeria, let’s dive in!

7 factors to consider before investing in real estate in Nigeria

- Economic and political stability

- Location

- Infrastructure

- Legal and Regulatory Environment

- Land Laws and Titles

- Financing Options

- Risks and Returns

1. Economic and Political Stability

The current economic and political climate in Nigeria can have a significant impact on real estate investments. Before investing, it’s important to research and understand Nigeria’s economic and political landscape. This will help you make informed decisions and mitigate risks.

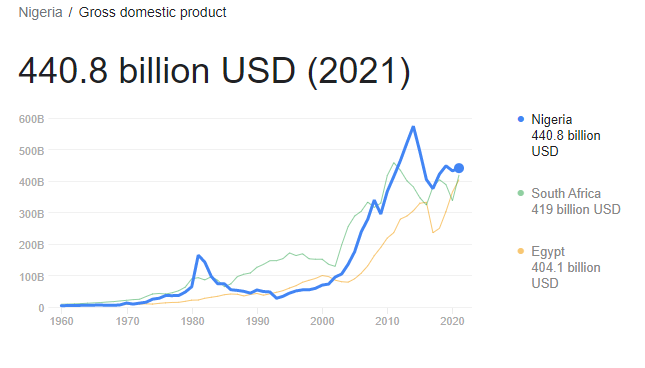

Nigeria has one of the largest economies in Africa, with a GDP of over $400 billion.

However, the country’s economy is heavily reliant on oil, which makes it vulnerable to fluctuations in oil prices. As a result, the Nigerian economy has experienced significant fluctuations over the years.

In addition to economic stability, it’s important to consider the political stability of Nigeria. The country has experienced political instability over the years, with coups, military regimes, and civil unrest. However, the country has made progress in recent years, with the peaceful transfer of power in 2015 and 2019.

2. Location

The location of a property is one of the most important factors to consider when investing in real estate. In Nigeria, some of the best locations for real estate investments include Lagos, Abuja, and Port Harcourt. Lagos is the commercial hub of Nigeria, while Abuja is the capital city and the centre of political power. Port Harcourt is a major industrial hub, with a thriving oil and gas industry.

When choosing a location, it’s important to consider factors such as accessibility, proximity to amenities, and security. Properties located in prime locations are likely to attract higher rental yields and appreciate faster.

Related: Top 15 Locations for Real Estate Investment in Lagos

Risks associated with investing in real estate in Nigeria and mitigations

3. Infrastructure

Infrastructure is another important factor to consider when investing in real estate in Nigeria. The country has been making progress in improving its infrastructure, with the government investing heavily in roads, bridges, and airports.

However, there is still a lot of work to be done, especially in areas such as power and water supply. Properties located in areas with good infrastructure are likely to be more attractive to tenants and appreciate faster.

4. Legal and Regulatory Environment

The legal and regulatory environment for real estate investments in Nigeria is complex and can be challenging to navigate. It’s important to understand the laws and regulations governing real estate investments in Nigeria before making any investments.

The Nigerian government is currently working on reforms to improve the legal and regulatory environment for real estate investments. These reforms include the Land Use Act and the Nigerian Mortgage Refinance Company.

Related: Properties in High Demand in the Nigerian Real Estate Market

How to Analyze a Real Estate Investment Opportunity

5. Land Laws and Titles

Land laws and titles in Nigeria are important factors to consider before investing in real estate in Nigeria. This is because the legal system surrounding land ownership in Nigeria can be complex and unclear, making it difficult to determine who actually owns a particular piece of land.

In Nigeria, land is generally owned by the government and can be allocated to individuals or organizations for use through a variety of means, such as leaseholds or freeholds. However, land titles in Nigeria can be uncertain and fraudulent, and many properties are not properly registered with the government.

To mitigate these risks, it is important for investors to conduct thorough due diligence before investing in real estate in Nigeria. This may include obtaining legal advice, conducting property searches, and verifying the authenticity of land titles and ownership documents.

In addition, there are specific laws and regulations governing land ownership and real estate transactions in Nigeria that investors must be aware of. For example, the Land Use Act of 1978 governs land ownership and usage in Nigeria, while the Nigerian Urban and Regional Planning Law regulates the development and planning of urban and regional areas.

Overall, investors must take the time to carefully navigate Nigeria’s complex legal system surrounding land ownership and titles in order to make informed decisions when investing in real estate in the country.

6. Financing Options

There are several financing options available for real estate investments in Nigeria, including mortgage loans, personal savings, and real estate investment trusts (REITs). It’s important to choose the best financing option based on your financial situation and investment goals.

Related: Real Estate Investing 101: Learn the Fundamentals of Real Estate Investment

Top Financing Options for Buying a House in Nigeria

7. Risks and Returns

Investing in real estate in Nigeria can be risky, and it’s important to understand the potential risks and returns before making any investments. Some of the risks associated with real estate investments in Nigeria include economic instability, political instability, and infrastructure challenges.

However, real estate investments in Nigeria can also be highly rewarding, with potential returns in the form of:

- Steady Income: Consistent earnings

- Appreciation: Increase in value

- Multipurpose Use: Utilize a property for multiple purposes

- Diversification: Variety in investments

- Control: Authority over investment decisions

- Leverage: The use of borrowed funds to increase investment potential

- Tangible Asset: Physical property that holds value

- Retirement Income: Earnings used to support oneself in retirement

- Legacy Building: Establishing a long-term financial legacy

- Inflation Hedge: Investment protection against rising prices

Related: 10 Amazing Benefits Of Investing In Real Estate in Nigeria

Residential or commercial real estate in Nigeria: Which is best

Conclusion on 7 factors to consider before investing in real estate in Nigeria

In conclusion, investing in real estate in Nigeria can be a lucrative and rewarding venture, but it requires careful consideration and due diligence. By keeping the factors mentioned in this blog post in mind and seeking advice from professionals, you can make informed decisions that will help you achieve your financial goals.

If you want to learn more about real estate investment in Nigeria, check out these related blog posts:

- “The 8 Best Ways to Invest in Real Estate in Nigeria: A Comprehensive Guide”

- “Diversifying Your Real Estate Portfolio: All You Need to Know”

- “The Top 9 Real Estate Investment Apps in Nigeria“

- What is the difference between Real Estate Investing and Stock Market Investing

- “Unlocking Real Estate Investment Opportunities in Lagos, Nigeria”

- “10 Mistakes to Avoid When Investing in Real Estate“

- “How to Invest in Real Estate with Little to No Money“

- “Pros and Cons of Investing in Real Estate in Nigeria“

By reading these posts, you can gain valuable insights and knowledge that will help you make informed investment decisions and achieve success in the Nigerian real estate market.

[…] 7 Factors to consider before investing in real estate in Nigeria […]

[…] 7 Factors to consider before investing in real estate in Nigeria […]

[…] Related: Factors to consider before investing in real estate in Nigeria […]

[…] 7 Factors to consider before investing in real estate in Nigeria […]

[…] 7 Factors to consider before investing in real estate in Nigeria […]

[…] 7 Factors to consider before investing in real estate in Nigeria […]

[…] Related: Factors to consider before investing in real estate in Nigeria […]

[…] Related: Factors to consider before investing in real estate in Nigeria […]